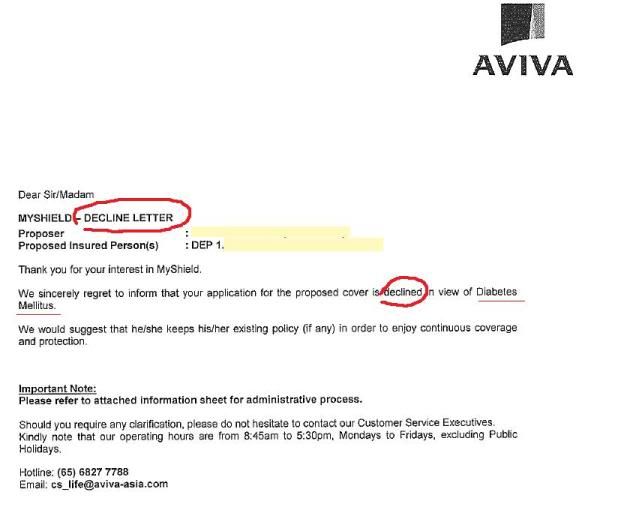

I got my first declined case today. To-date i have many smooth cases, helping friends to secure their responsibilities with a peace of mind. And today i got my first declined case, and that person who was rejected by insurance was my mom. Can you imagine how i felt when i told the news to my mom? That even though she has the money to buy insurance, no insurance companies are willing to accept her?

My mom does have insurance policies, she already bought long before i started my job, but when she was admitted to hospital last year for two surgeries, she was unable to claim any from insurance. Why? This is because whole life policy and savings policy does not cover hospitalisation bills. (At this point if you got no clue why is this so, then i suggest you better go check with your agent.) In fact, Hospital plans are the cheapest plans compared to whole life and savings plans. So why did my mom only bought life and savings plans? If her agent could convince my mom to afford them, surely she could afford a basic Hospital plan, which is pay using CPF MEDISAVE once a year only. Ask her agent who service her. Not doing a good job here definitely. Even though Hospital plan is cheap and commission very little to agents, but it is really an agent's responsibility to look out for the client's needs first, before selling products based on their commission.

P/S: One should get insurance when he/she is still healthy. There is no best timing, or wait for best timing to buy insurance, as you will never know the unpredictable.

|